The Evolution of Mutual Funds: From Inception to the Present

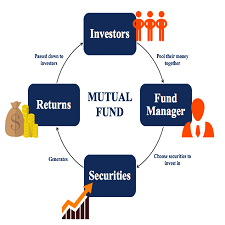

The Evolution of Mutual Funds: From Inception to the Present, Mutual funds have a rich and fascinating history that dates back over a century. These investment vehicles have become an integral part of the financial landscape, offering individuals a convenient way to invest in a diversified portfolio of stocks, bonds, and other securities. Let’s journey through the history of mutual funds from their inception to the present day.

Early Beginnings (Late 19th Century – Early 20th Century)

The concept of mutual funds traces its roots to the Netherlands in the 18th century, with the creation of “investment trusts.” However, the modern mutual fund industry as we know it today began to take shape in the United States during the late 19th and early 20th centuries.

1893 – The Birth of the First Mutual Fund-The Evolution of Mutual Funds: From Inception to the Present

The year 1893 marked a significant milestone with the establishment of the “Boston Personal Property Trust,” commonly recognized as the first mutual fund. It was founded by Paul M. Cabot and had a simple investment approach: to provide diversification for individual investors by pooling their money and investing it in a portfolio of bonds and stocks.

1920s – Proliferation and Regulation-The Evolution of Mutual Funds: From Inception to the Present

The mutual fund industry started to expand in the 1920s, but it wasn’t until the 1930s that significant regulatory changes occurred.

Lucky Baby Girl Names From the UK

The Securities Act of 1933 and the Securities Exchange Act of 1934 were enacted to protect investors from fraudulent schemes and ensure transparency in the securities market. These regulations provided the foundation for the modern mutual fund industry.

Post-World War II Boom (1940s – 1950s)

The mutual fund industry experienced substantial growth after World War II, as more Americans turned to investing in the stock market. In 1940, the Investment Company Act and the Investment Advisers Act were passed, further regulating mutual funds and investment advisors.

The 1960s – The Rise of Equity Funds-The Evolution of Mutual Funds: From Inception to the Present

Throughout the 1960s, equity funds, which primarily invested in stocks, became increasingly popular. This shift in investment focus reflected the growing interest in the potential of the stock market as a wealth-building tool.

Read here – How to Start Investing in Stocks

1970s – The Introduction of Money Market Funds

The 1970s saw the introduction of money market funds, which offered an alternative to traditional savings accounts by providing investors with a low-risk, easily accessible option for parking their cash.

Love Calculator

1980s – A Boon for Bond Funds-The Evolution of Mutual Funds: From Inception to the Present

The 1980s witnessed a surge in bond funds due to falling interest rates. Investors turned to bond funds as a way to benefit from rising bond prices while enjoying regular interest income.

1990s – The Era of Growth and Technology Funds

The 1990s were marked by the dot-com bubble, which led to a significant rise in technology and growth-oriented funds. Investors flocked to funds that held shares of high-flying tech companies.

Early 21st Century – Challenges and Reforms

The mutual fund industry faced challenges in the early 2000s, including scandals related to market timing and late trading. In response, regulatory reforms were introduced to protect investors and enhance transparency.

Read here – How Much is a Gold Bullion Bar Worth

Present Day-The Evolution of Mutual Funds: From Inception to the Present

Today, the mutual fund industry has grown into a vast and diverse landscape. There are mutual funds to suit nearly every investment objective, from conservative money market funds to aggressive sector-specific equity funds.

Behind the Steel Curtain

With the advent of the internet and online investing platforms, investors have easy access to research, information, and the ability to invest in mutual funds from anywhere in the world.

Mutual funds continue to be a popular choice for both individual and institutional investors, offering a well-regulated and diversified investment option.

Must read here – How to Invest in the Stock Market for Beginners

They have evolved to accommodate changing market dynamics and investor preferences, and their role in shaping the financial future of millions of people worldwide remains as critical as ever.

In conclusion, the history of mutual funds is a tale of innovation, regulation, and adaptation. Over the years, these investment vehicles have provided millions of investors with the opportunity to participate in the financial markets, and their legacy continues to grow as they adapt to the ever-changing investment landscape.