Mastering the Mental Game: Understanding Day Trading Psychology

Introduction-Day Trading Psychology

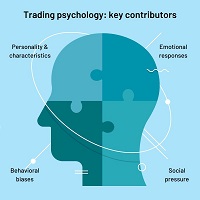

Day exchanging is a dynamic and speedy endeavor that requires specialized skill as well as a profound comprehension of the mental viewpoints included. Fruitful day exchanging goes past breaking down outlines and executing exchanges; it requires areas of strength for grit to explore the ups and downs of the market. In this exploration of day trading psychology, we will delve into the key psychological factors that influence day traders and discuss strategies to master the mental game.

I. The Mindset of a Successful Day Trader

A. Discipline: The Foundation of Success

Discipline is the bedrock of successful day trading. It involves sticking to a well-thought-out trading plan and avoiding impulsive decisions. Maintaining discipline helps traders weather the storm during inevitable losing streaks and prevents overtrading—a common pitfall for many.

B. Patience: Waiting for the Right Opportunities

Day trading often involves swift decision-making, but successful traders know the value of patience. Waiting for high-probability setups and avoiding FOMO (Fear of Missing Out) are crucial components of a patient and disciplined mindset.

Read Here – Risk Management in Day Trading

II. Embracing Risk: Fear and Greed-Day Trading Psychology

A. Overcoming Fear

Fear is a natural emotion in trading, especially when facing financial risk. Successful day traders acknowledge fear but do not let it control their decisions. Techniques such as setting predetermined stop-loss levels and position sizing help mitigate the impact of fear on trading outcomes.

B. Managing Greed

Greed can be just as destructive as fear in day trading. It often leads to holding onto winning trades for too long, neglecting risk management, and chasing unrealistic profits. Developing a realistic profit-taking strategy and regularly reassessing risk tolerance is essential in managing the influence of greed.

III. Handling Losses: The Art of Bouncing Back

Must Read – Intraday Trading Strategies

A. Acceptance and Learning

Losses are an inevitable part of day trading. Emotionally resilient traders accept losses as part of the game and use them as learning opportunities. Rather than dwelling on failures, successful day traders focus on analyzing their mistakes, adapting their strategies, and continuously improving.

B. Avoiding Revenge Trading

Experiencing a losing trade can trigger emotions like frustration and anger. Revenge trading, or attempting to recoup losses by making impulsive and emotionally driven trades, is a common trap. Successful day traders recognize revenge trading as self-destructive behavior and take steps to break this cycle.

IV. Stress Management: A Healthy Body, A Healthy Mind-Day Trading Psychology

A. Physical Well-being

The requesting idea of day exchanging can negatively affect both mental and actual well-being. Normal activity, legitimate nourishment, and adequate rest add to ideal mental capability and profound prosperity. Traders who prioritize their physical health are better equipped to handle the challenges of the market.

B. Mindfulness and Relaxation Techniques

In the heat of trading, stress levels can escalate rapidly. Incorporating mindfulness and relaxation techniques, such as meditation or deep breathing exercises, can help day traders stay focused and calm under pressure. These practices contribute to better decision-making and overall mental resilience.

V. Continuous Learning: Adapting to Market Changes

Must read this post – Investing in Gold Mining Stocks in 2023

A. Staying Informed

The financial markets are dynamic, and successful day traders stay informed about market trends, economic indicators, and global events that could impact their trades. Continuous learning and staying abreast of market developments provide the knowledge necessary to make informed decisions.

B. Adapting to Market Conditions

Adaptability is a sign of effective informal investors. Markets develop, and techniques that once worked may turn out to be less powerful. Brokers who can adjust to changing economic situations, refine their procedures, and embrace new advancements are better suited for long-haul achievement.

Conclusion – Day Trading Psychology

Mastering day-trading psychology is a continuous journey that requires a combination of mental discipline, emotional resilience, and a commitment to ongoing learning.

Successful day traders understand that achieving consistent profitability is not just about analyzing charts and executing trades; it’s about developing a resilient mindset that can navigate the complex and ever-changing landscape of the financial markets.

By embracing the principles of discipline, patience, risk management, and continuous learning, day traders can elevate their mental game and increase their chances of long-term success in this challenging yet rewarding field.